What is prepaid insurance?

Content

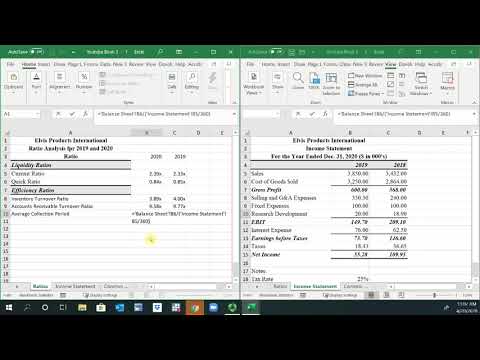

In this way, prepaid insurance has economic value, not unlike an investment in stocks or bonds, that can be redeemed at a later time. The adjusting journal entry is done each month, and at the end Prepaid Insurance Definition, Journal Entries of the year, when the lease agreement has no future economic benefits, the prepaid rent balance would be 0. Demonstrates the equality of debits and credits after recording adjusting entries.

As previously explained, prepaid expenses are to be recorded as a type of current asset on the firm’s balance sheet. On the contrary, all accrued expenses have to be reported as a form https://kelleysbookkeeping.com/ of current liability on the balance sheet. This is because accrued expenses are costs that the business incurs but has not made the payment for at the end of a financial period.

Not tracking the expiration date of prepaid expenses

In summary, Kolleno is an all-in-one software that can be integrated into a business’s existing workflow, with the accounting team being seamlessly onboarded in no time. Thus, the firm need not waste time and human resources to learn a completely novel accounting tool for their day-to-day operations. When recording transactions individually, there is a higher risk of data entry errors, especially when there is a high volume of transactions. By summarizing transactions, businesses can reduce the chance of data entry errors, ensuring the accuracy of their financial records. They are expenses paid in advance for benefits yet to be received.

For example, every company must pay an insurance fee to protect its assets, employees, etc. When the insurance premium is paid in advance, that is called prepaid insurance. A current asset which indicates the cost of the insurance contract that have been paid in advance.

Accumulated Depreciation on Balance Sheet

ParticularsDebitCreditInsurance Expense A/c$2,000 To Prepaid Insurance A/c$2,000The income statement for the quarter ending will show an expense of $2,000 under the line item of Insurance Expense. ParticularsDebitCreditPrepaid Insurance A/c$10,000 To Bank/Cash A/c$10,000Prepaid Insurance is debited, which indicates the creation of an asset on the balance sheet. Entry to record revenue earned that was previously received as cash in advance.

How do you record a prepaid journal entry?

- Make the payment for the prepaid expense.

- Enter it into an accounting journal.

- Debit the asset account.

- Expense a portion on the income statement.

- Repeat the process.

Drive accuracy in the financial close by providing a streamlined method to substantiate your balance sheet. The preceding discussion of adjustments has been presented in great detail because it is imperative to grasp the underlying income measurement principles. Perhaps the single most important element of accounting judgment is to develop an appreciation for the correct measurement of revenues and expenses. These processes can be fairly straightforward, as in the preceding illustrations. A business process rarely starts and stops at the beginning and end of a month, quarter or year – yet the accounting process necessarily divides that flowing business process into measurement periods. Recall that prepaid rent related to rent that was paid in advance.

What is the best way to estimate the amount of a prepaid asset's monthly benefit?

Let us look at the balance sheet at the end of one month on December 31, 2017. The estimated residual value is the amount that the company can probably sell the asset for at the end of its estimated useful life. The amount of interest therefore depends on the amount of the borrowing (“principal”), the interest rate (“rate”), and the length of the borrowing period (“time”).

The trial balance, drawn up on 31 December 2019, assumed that he had no other insurance and his insurance expenses account would show a balance of $4,800. Prepaid expenses only turn into expenses when you actually use them. The value of the asset is then replaced with an actual expense recorded on the income statement. Prepaid expense is first recorded as an asset and later debited as an expense. Hence, it can be recorded by using the asset method and expense method of accounting.

A prepaid expense journal entry is a transaction recorded in the accounting books to recognise an expense that has been paid in advance. The journal entry debits the prepaid expense account and credits the cash account, reflecting the payment made. As time passes, the prepaid expense account is gradually reduced and transferred to the appropriate expense account. By treating prepaid expenses as assets, businesses can accurately reflect the value of future economic benefits on their balance sheet.