Currensee Correlation OANDA

Contents:

Perhaps the best known correlation of all is between the US dollar and gold. Gold is priced in US dollars, so its price is hugely dependent on the strength of the currency. When USD rises, gold’s price will often fall – a strong negative correlation. For example, if you have open short positions on two markets with a 75% positive correlation, then it is probable that a bear trend in one will lead to the same move in the other. While it can be useful for spotting opportunities, it can also increase your risk if you aren’t careful.

After entering the pair you are trading, the time frame you want to see correlation levels for, and how many periods to calculate, you will quickly see the other pairs that are most likely aligned. On the US side, there are varying insights on the impact of the strength of USD on stocks. As the US dollar weakens, the revenues generated by exports are larger when converted back into dollars . Correspondingly, a stronger dollar means US multinationals get less favorable exchange rates when international profits are translated back into USD. In times of high volatility, markets tend to become more correlated, which may increase your overall risk.

Negative Correlation Pairs

FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. This is for general information purposes only – Examples shown are for illustrative purposes and may not reflect current prices from OANDA. This is especially helpful if you want to understand currency strength. By looking at such a Forex triad, you can see which of the three is the strongest and weakest. Also, whenever you have a Forex triad, there are usually 2 Forex pairs moving strongly while one ranges sideways. Knowing if investors are looking for ‘safe’ investments or riskier alternatives can be very helpful because you can understand which Forex pairs are likely to move the most.

If you enter two trades where the pairs are closely correlated, you risk having two large winners or two large losses. The correlation coefficient is a statistical measure of the strength of the relationship between two data variables. On the other hand, holding long EUR/USD and long AUD/USD or NZD/USD is similar to doubling up on the same position since the correlations are so strong.

What Are The Pros And Cons Of Forex Trading?

For example, to express a bearish outlook on the USD, the trader, instead of buying two lots of the EUR/USD, may buy one lot of the EUR/USD and one lot of the AUD/USD. Lots of currency pairs are closely correlated to commodities. This usually occurs when an economy is dependent on commodities to grow. Australia, for instance, derives a large portion of its wealth from metals mining.

Value at risk is a tool to measure the risk of loss on a portfolio. The tool gives the best size of the position for forex trading. Forex trading is challenging and can present adverse conditions, but it also offers traders access to a large, liquid market with opportunities for gains. Bitcoin , Ethereum , Litecoin , Bitcoin Cash and Ripple are leading cryptocurrency products. I will surely place an order in USDCHF after the trendline breakout. But if I place an order in two pairs USDCHF and USDSGD by dividing Risk.

For example, having three trades on (GBP/NZD, USD/JPY, and EUR/JPY) means you can run an analysis between the three markets to make sure they are not correlated, effectively diversifying your trades. GBP/USD and USD/CHF, as an example, shows a positive correlation over the shorter timeframe of 20 days. However, the pairing is overall regarded as a negative correlation for similar reasons to USD/CHF and EUR/USD. CHF is a safe haven currencyand can appreciate dramatically when economic turmoil hits and equities fall, which is one reason that might explain the negative figures.

A trader’s guide to currency pair correlations in the forex market – IG UK

A trader’s guide to currency pair correlations in the forex market.

Posted: Tue, 14 Jan 2020 00:14:42 GMT [source]

All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Correlation ranges from -100% to +100%, where -100% represents currencies moving in opposite directions and +100% represents currencies moving in the same direction. If the correlation is high and negative then the currencies move in the opposite way. If the correlation is high and positive then the currencies move in the same way. Trading Station, MetaTrader 4 and ZuluTrader are four of the forex industry leaders in market connectivity. Trade your opinion of the world's largest markets with low spreads and enhanced execution.

What is Currency Correlation?

Test out our risk-free demo account to practise trading on the financial markets with £10,000 of virtual funds, or gain access to 12,000+ instruments right away with a live account. On our platform, any currency can be dragged from the product list onto an existing chart of any currency pair to show both currency pairs on the same chart. These pairs typically move together, but in this example, they moved in opposite directions. There are many ways that correlations can be used as part of a forex trading strategy, such as through hedging, pairs trading and commodity correlations.

USD/ZAR near key technical level ahead of SARB – FOREX.com

USD/ZAR near key technical level ahead of SARB.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

A negative correlation can also be called an inverse correlation. To be an effective trader and understand your exposure, it is important to understand how different currency pairs move in relation to each other. Some currency pairs move in tandem with each other, while others may be polar opposites. Learning about currency correlation helps traders manage their portfolios more appropriately. The search for measurable correlations and the strategies in which they are incorporated knows no bounds. Whether attempting to find a short-term arbitrage opportunity, or diversifying a large investment portfolio, currency correlations play an integral role in a trader or investor's strategy.

What is Forex Currency Correlation?

We have no idea how one pair will move in relation to the other. Learn how to trade forex in a fun and easy-to-understand format. Above all, Intermarket analysis helps to achieve a better overall understanding of the financial markets in general. A modification of the correlation, principally over the long-term, may demonstrate that the market is undergoing a change.

- Of course I’m only concerned with the daily time frame as that’s what I trade and what I teach as part of my Forex trading course.

- Because the two currency pairs are almost exact opposites, both trades are essentially the same.

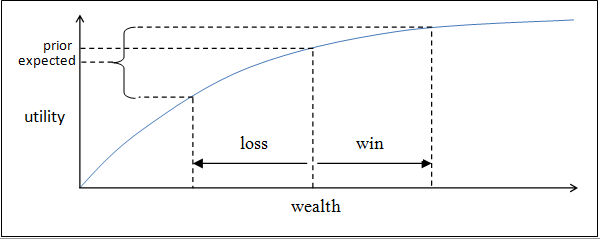

- The top part of the equation is the covariance and the bottom part is the standard deviation.

- Therefore, if currency pairs are said to have negative correlation, it means that whilst one pair is moving, the other pair is likely to be moving down and vice versa.

- I will surely place an order in USDCHF after the trendline breakout.

- For example, the EUR/USD and AUD/USD share a strong positive correlation in the table above at 75.

As you scroll down on the page, you’ll notice four different time frames for the currency pairs you selected. The second step when using the Forex correlation table is selecting your currency pairs. This is where you’ll choose the pairs you want to show up in the correlation table. One thing to keep in mind when it comes to Forex correlations, is that they do change over time.

AUD/USD Correlations

When placing a https://1investing.in/, consider whether the markets are currently correlated, whether one market leads another, and whether price is diverging. For example, if one market is making lower lows or higher highs and the other is ranging, it may be worth waiting for a period of sustained correlation. You can use correlations to help with risk by making sure you aren’t accidently doubling up on one side of a currency trade. Use the correlations to help confirm if a breakout is real or not, and also help to manage your winning trades. Type in the correlation criteria to find the least and/or most correlated forex currencies in real time.

The charts give precise details on the correlation between two parities. They show the history and the distribution of the correlation over a given period. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Familiarity with the wide variety of forex trading strategies may help traders adapt and improve their success rates in ever-changing market conditions.

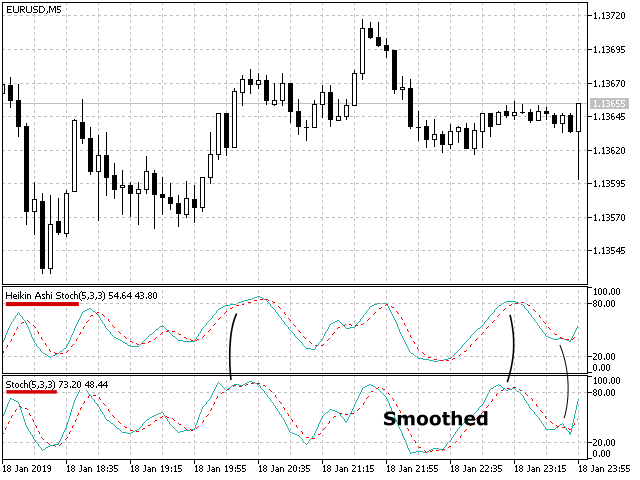

It offers a quick way to measure if two pairs are correlated or not. The first image shows the negative correlation between Gold and USD/JPY. When the USD/JPY goes up, investors are selling the Yen and selling gold.

OANDA Corporation ULC accounts are available to anyone with a Canadian bank account. A brochure describing the nature and limits of coverage is available upon request or at When it comes to Forex correlations, there are a handful you need to know about. Decide whether to buy or sell and determine entry and exit points, keeping an eye out for profit or loss. A coefficient near or at zero indicates a very weak or random relationship.

In valuation methods 2s of uncertainty, the USD/JPY will fall because people buy the Yen and also gold. It is possible to make money trading, but it comes with many risks and extra costs that must be taken into consideration. Consult our section on ‘what else do you need to know’ before opening a potentially risky trade. In the case of the GBP/USD and EUR/GBP, there is a negative correlation.

Trading correlated forex pairs are very easy and safe in terms of risk management. Simply correlation means the link between the two identities which comes to be in between the currencies when we are dealing with forex trading. The two possibilities here are that either both move in the same direction showing a positive correlation or in opposite direction showing a negative correlation. Correlation allows traders to hedge positions by taking a second trade that moves in the opposite direction to the first position. A currency hedge is achieved when gains from one pair are offset by losses from another, or vice versa. This may be useful if a trader doesn’t want to exit a position but wants to offset or reduce their loss while the pair pulls back.

There is no default currency correlation indicator on the MT4 trading platform; however, it does have a vast library of downloadable indicators in the Market and Code Base sections of the platform. These are often created and shared by third party users, so some indicators may be better than others. You can filter indicators by name, so typing in “correlation” in the Code Base section will often find relevant add-ons for the system.

Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold The Forex Geek and any authorized distributors of this information harmless in any and all ways. You can see in the EUR/USD and GBP/USD 1-hour charts below that they are moving in a very similar direction. One could argue that if you are trading long on both pairs, it would be similar to having one larger position on either of them. One of the easiest ways to see the potential positive and negative correlation for your Forex trades is by using a calculator.

The correlation value of 1 means both currencies will move in the same direction either bullish or bearish. I’ve found this correlation table to be the best, but that doesn’t mean it’s the only one available. The Yen futures and gold often move in lockstep with very high correlation. The screenshot also shows the correlation to US Treasuries which is also positive. Learn about the four trading principles of preparation, psychology, strategy, and intuition, and gain key trading insights from some of the world's top investors.

Bitcoin Correlation With The S&P 500 Falls To FTX Collapse Levels, But Why? Bitcoinist.com – Bitcoinist

Bitcoin Correlation With The S&P 500 Falls To FTX Collapse Levels, But Why? Bitcoinist.com.

Posted: Fri, 24 Feb 2023 01:33:21 GMT [source]

Values that are close to zero are considered to be very slightly correlated; thus the closer to zero we move on the scale, the slighter the correlation. Correlation in forex matters a lot to refine the best trading setups from different currency pairs. Although option two is feasible, it isn’t altogether logical in my opinion. Because the two currency pairs are almost exact opposites, both trades are essentially the same. It’s usually best to simplify things and take just one of the two trades.